Management Forex Money

Everybody knows how vital it is to implement risk management strategies when day trading. but unfortunately many traders ignore them due to a wide range of factors. we have collected the list of 10 most efficient money management strategies that can help you become a successful forex trader. When trading forex, getting the direction of the trade right is only one side of the coin. money management is the other side. even the best trades and the most profitable trading strategies won’t do much if you don’t have strict money management rules in place to protect your winning trades, cut your losses, and grow your trading account. Money management that actually works inforex! when people first come to trading and in particular forex the first thing they look to do is find the shiniest and fanciest trading system they can get their hands on. the thinking goes that if they can just find the latest and greatest system all their dreams will come true management forex money and the millions will come rolling in.

Forexmoneymanagement tries to balance two things: restricting worst-case scenario losses to an acceptable level and maximising potential profits. in other words, we are trying to avoid risking so much that you lose everything or are compelled to stop, or trading so conservatively that most of your money is still in your wallet when you win. Tip 4. manage forex risk by limiting your use of leverage. linked to the previous forex risk management tip is limiting your use of leverage. leverage, in a nutshell, offers you the opportunity to magnify profits made from your trading account, but it also increases the potential for risk. for example: leverage of 1:200 on a $400 account means that you can place a trade for up $80,000 ($400 x 200).

Essentially, this is how risk management works. if you learn how to control your losses, you will have a chance at being profitable. in the end, forex trading is a numbers game meaning you have to tilt every little factor in your favor as much as you can. Forexmoneymanagement is the single most important factor that determines your long-term success in the forex market. many traders have difficulties with sticking to a solid forex money management plan, which is one of the main reasons why so many traders are unprofitable in this market. Essentially, this is how risk management works. if you learn how to control your losses, you will have a chance at being profitable. in the end, forex trading is a numbers game meaning you have to tilt every little factor in your favor as much as you can. Fx money management is management forex money the one thing that makes your account go up or down. so why do so many videos ignore it? i know exactly why, and we talk about it in video 1 of my forex money management.

What is forex risk management? babypips. com.

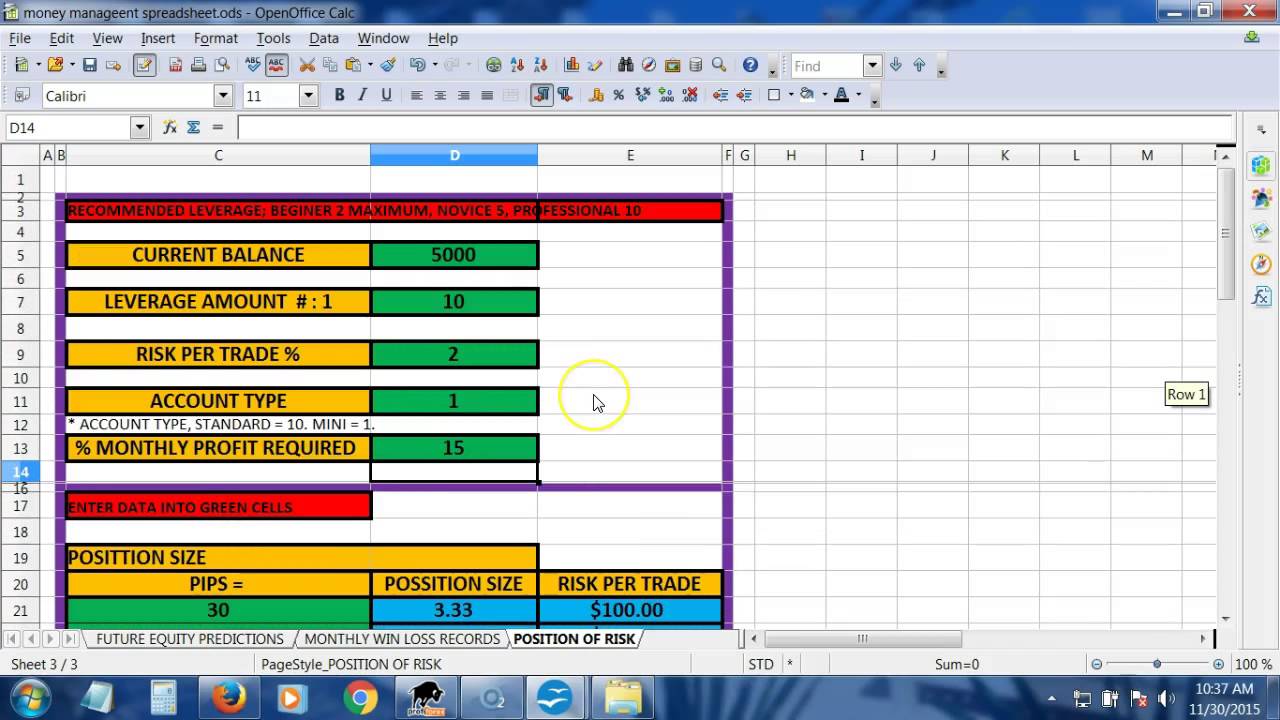

Money management is perhaps the least realized and most important weapon in a trader’s arsenal. a large percentage of forex traders fail because they don’t have the concept of money management firmly in their grasp. in order to constantly wager hundreds or thousands of dollars, traders have to know the potential of every penny they are risking. The position size calculator will calculate the required position size based on your currency pair, risk level (either in terms of percentage or money) and the stop loss in pips.

The Money Management Forex Traders Must Understand Youtube

Forex trading money management system: crush the forex market with bigger profits and smaller losses! [guy, don] on amazon. com. *free* shipping on management forex money qualifying offers. forex trading money management system: crush the forex market with bigger profits and smaller losses!. While there is much focus on making money in forex trading, it is important to learn how to avoid losing money. proper money management techniques are an integral part of the process. Introduction: money management in forex. in this article, you’re going to learn everything you need to know about money management in forex. we have discussed all the angles on and the importance of stop losses in the articles called “the ultimate guide on stop losses”, click here for part 1 and click here for part 2. if you have not read that guide, make sure to take a look!. Moneymanagement แปลว่า. money management หากเขียนเป็นคำไทย น่าจะหมายถึงการบริหารจัดการเงินทุนของคุณ สำหรับการเทรด forex บางทีแล้วคุณอาจได้เห็นเป็นตัวอักษรย่อ.

See more videos for money management forex. Creating a forex money management strategy and risk control plan doesn’t have to be a difficult task. in fact, it’s one of the easier things you can do to protect your trading capital. despite this truth, it’s often overcomplicated to the point that most traders fail to create a proper strategy. this is a huge oversight. What is money management forex. in forex and binary options trading, money management is very management forex money important for gaining huge amounts of profit. by money management, we mean to manage the money properly. forex money management means the money invested in a trade and the risk involved in the trade and managing investment along with the risk involved in the trades. Money management that actually works in forex! when people first come to trading and in particular forex the first thing they look to do is find the shiniest and fanciest trading system they can get their hands on. the thinking goes that if they can just find the latest and greatest system all their dreams will come true and the millions will come rolling in.

Money management is perhaps the most important technique traders need to understand when trading the forex market. although money management is a wide and flexible topic, the mentioned points in this article give you an overview of the basics you need to be aware of as a forex trader. Contoh money management forex. metode money management apapun pada dasarnya berakar pada pertanyaan mengenai berapa besar dana yang berani anda management forex money risikokan. "risiko" di sini bisa diartikan risiko loss yang ingin diambil per trading. pertama-tama, tentukan dulu jumlah loss maksimal yang sanggup anda terima. kita ambil contoh risiko 2% per trading. 13. money management forex excel no need to look for expensive money management software or money management in forex excel files already done. check your market exposure in real-time. although you want to make gains as quickly as possible, the first and most important thing you can do is stay in trading without losing money.

What Is Forex Risk Management Babypips Com

Money management แปลว่า. money management หากเขียนเป็นคำไทย น่าจะหมายถึงการบริหารจัดการเงินทุนของคุณ สำหรับการเทรด forex บางทีแล้วคุณอาจได้เห็นเป็นตัวอักษรย่อ.

The proper application of money management gives a forex trader an account growth edge, while trading forex without a logical money management strategy typically amounts to little more than gambling. this explains why forex risk and money management practices remain an essential part of the business that needs to be incorporated into every. Moneymanagement is perhaps the most important technique traders need to understand when trading the forex market. although money management is a wide and flexible topic, the mentioned points in this article give you an overview of the basics you need to be aware of as a forex trader.

Belum ada Komentar untuk "Management Forex Money"

Posting Komentar